Empowering Agriculture with Smart Financial Solutions

Overview

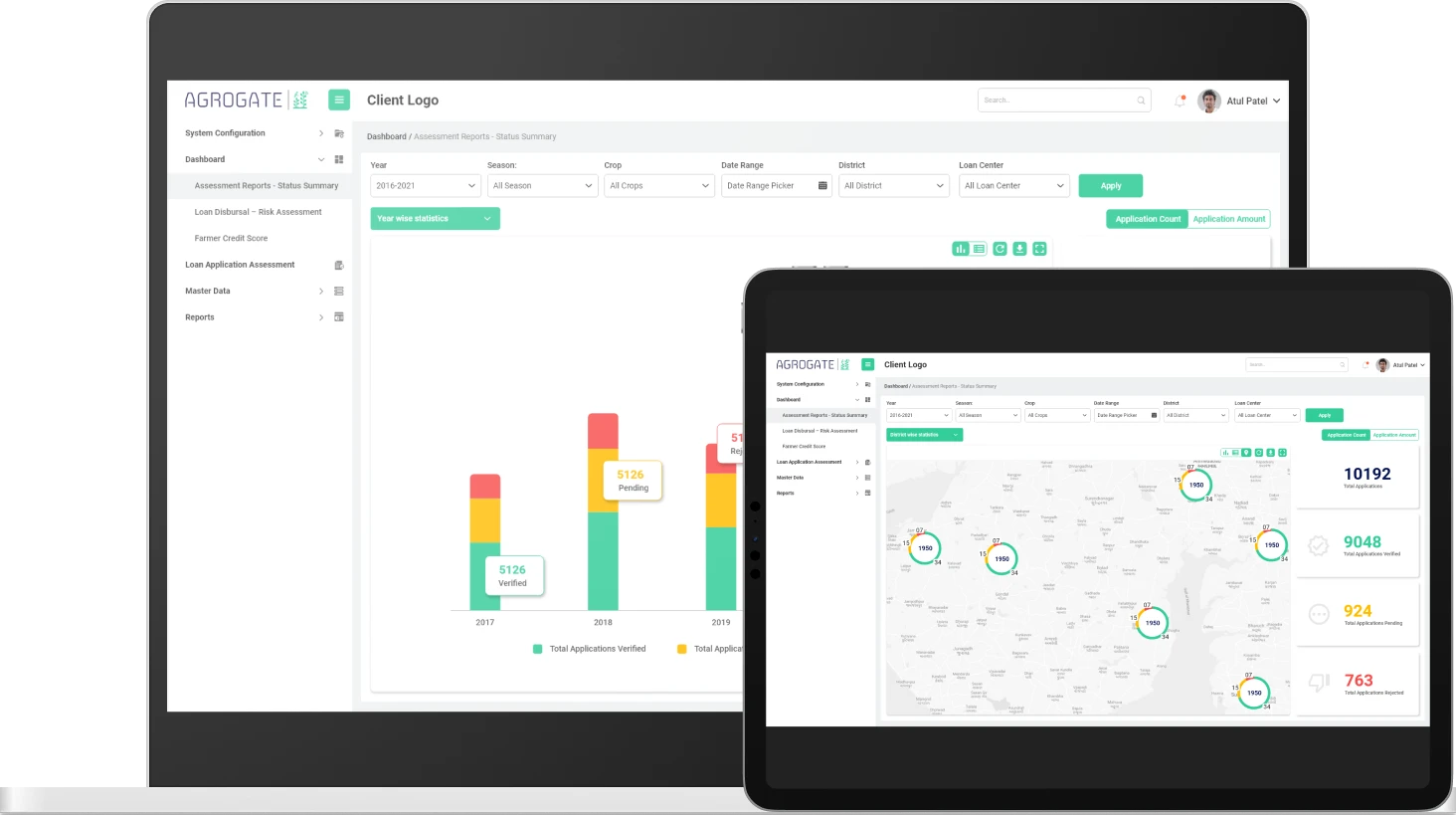

Agrogate Finance transforms agricultural lending by integrating geospatial technology with traditional financial metrics. By streamlining loan applications, enhancing credit scoring, and providing real-time data insights, Agrogate Finance enables financial institutions to assess farm creditworthiness accurately and efficiently. This innovative platform supports farmers with transparent loan processes and improved access to credit, ensuring a more sustainable and informed agricultural finance ecosystem.

Key Features

Modular and Scalable Architecture

Ensures flexibility with independent modules, allowing easy updates and integration.

Real-Time Farm and Loan Data

Provides current information on farms, loans, and crop health for timely decision-making.

Secure Data Protection

Uses encryption and compliance mechanisms to safeguard sensitive information.

Centralized Loan Management

Combines application monitoring, digital credit scoring, and risk assessment for efficiency.

Efficient Loan Processing

Accelerates assessments using farm-specific data for precise loan evaluations.

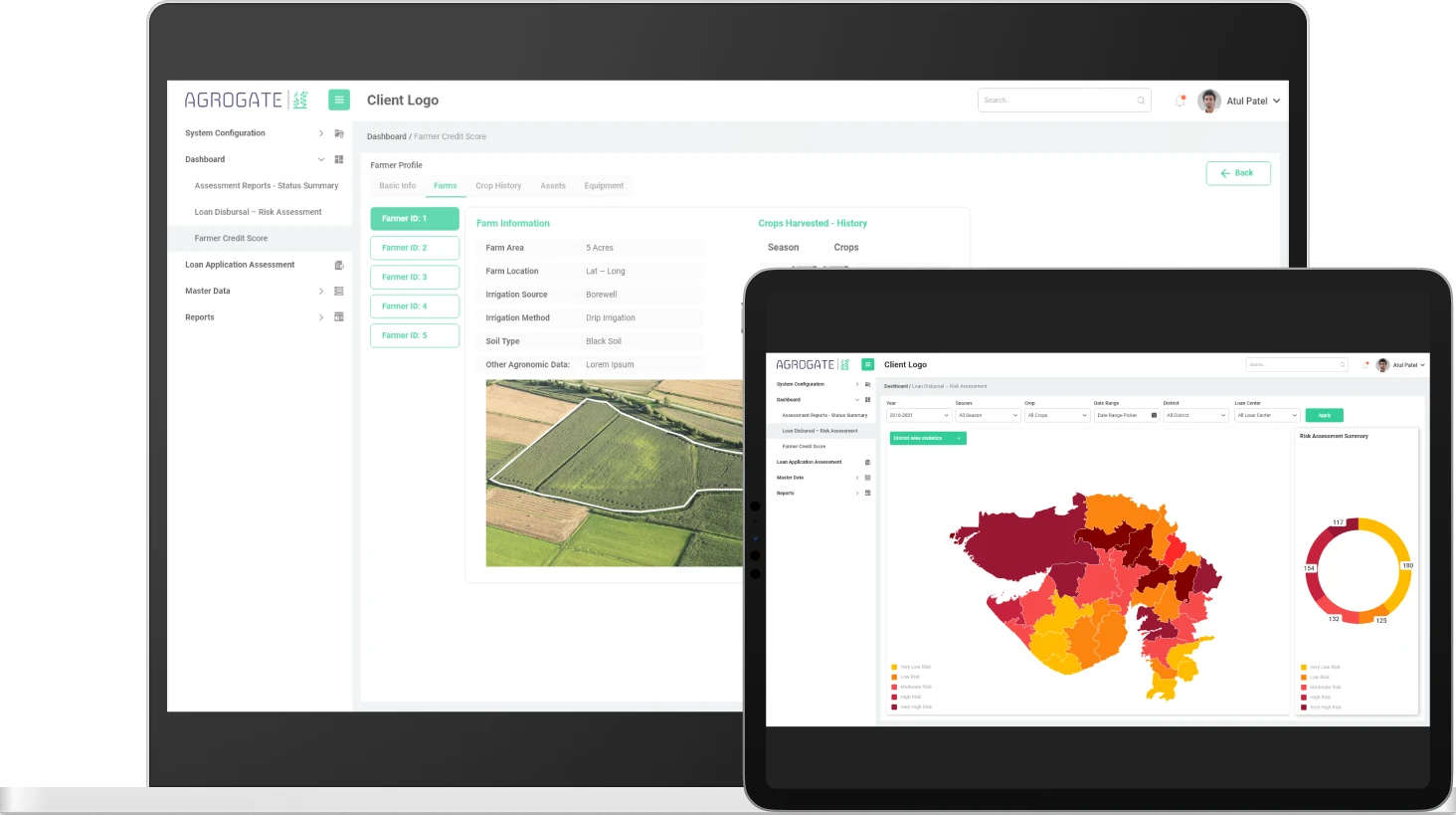

Geo-Tagged Farm Profiles

Records accurate farm locations with geo-tagging, creating a reliable KYC system.

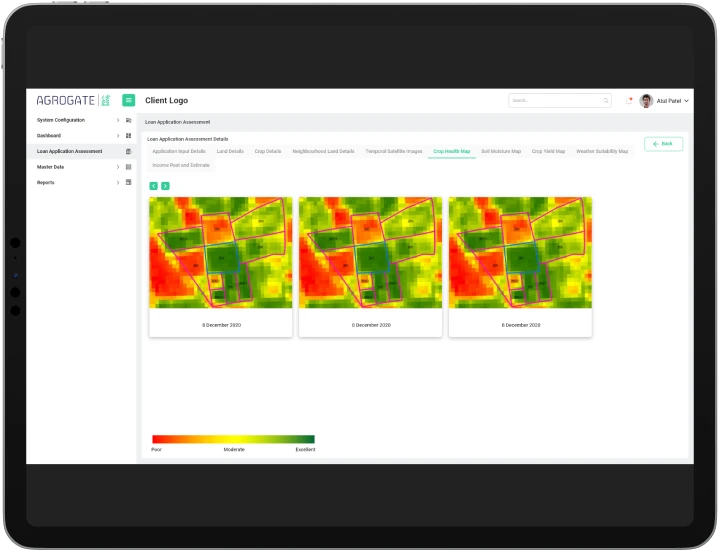

Satellite-Based Crop Monitoring

Tracks crop condition with satellite imagery, aiding credit decisions and risk management.

Benefits

Tailored Loan Management Tools

Enhances efficiency with tools designed for agricultural finance.

Accurate Crop Insurance Assessment

Uses satellite data for precise risk evaluation and premium calculation.

Data-Driven Lending Decisions

Integrates agricultural data with financial metrics for informed decisions.

Transparent Loan Execution

Increases transparency in loan status and policy execution, benefiting farmers.

Streamlined Loan Application

Speeds up the process, reducing risk for lenders and improving farmer access to credit.

Real-Time Financial Support

Provides farmers with real-time data and comprehensive assistance for timely financial aid.

Improved Farm Credit Scoring

Provides detailed insights into productivity, reducing lending uncertainty.