Agriculture

Digital Land & Crop Verification

For KCC Loans

Business Background

Verifying land ownership and crop conditions for Kisan Credit Card (KCC) loans was a persistent challenge in remote and semi-urban regions of Andhra Pradesh. Traditional manual verification processes were slow, inconsistent, and lacked real-time visibility—leading to delays in loan disbursement, inaccurate credit evaluations, and a higher risk of defaults. To overcome these hurdles, a digital-first approach was needed to automate assessments, strengthen risk profiling, and accelerate loan approvals.

Lending Transformed

Amnex Solution

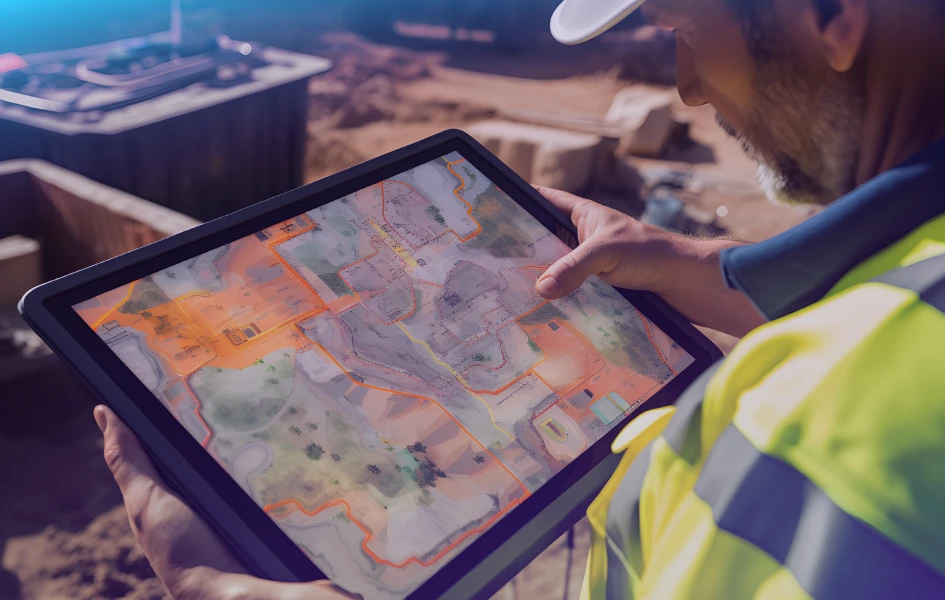

Amnex introduced an AI-powered, geospatial intelligence platform to revolutionize land and crop verification. By using satellite-based crop monitoring and AI-driven health assessments, the system delivered accurate, real-time insights into farm conditions. Digital land verification reports combined historical satellite data with on-ground validation, while an integrated portal streamlined KCC tracking and farmer profiling. A custom analytics dashboard empowered banks with actionable insights into crop trends and land use patterns.

Impact

Faster Loan Processing

Automated land and crop validation cut loan turnaround time significantly.

Reliable Assessments

Satellite imagery and AI delivered pinpoint accuracy in verifying land ownership and crop status.

Smarter Credit Decisions

Real-time and historical insights enhanced data-driven lending strategies.

Reduced Manual Effort

End-to-end digital processes minimized human error and clerical work.

Lower Credit Risk

Risk profiling with anomaly detection flagged potential defaulters early.

Transparent Workflow

Secure digital platform ensured traceable, auditable verification flows.

Scalable Framework

Built to expand across geographies, adapting to diverse agricultural ecosystems.