bLOG

Rebuilding Trust in Farm Finance Through Evidence, Not Assumptions

Admin – 01/01/2026

What if agricultural loans weren’t decided by forms, files, and field visits that arrive too late?

What if finance could see the farm as it truly is

before approving credit,

before risks compound,

before repayments fail?

For decades, agricultural finance has worked around a blind spot. Lending decisions are made upfront, while the farm itself remains largely invisible until harvest — or worse, until default.

That gap is where uncertainty lives.

The Problem Was Never Agriculture. It Was Visibility.

Financial institutions supporting farmers face a familiar dilemma.

Land records may exist, but do they reflect current cultivation?

Crop declarations are submitted, but are they accurate?

Productivity is assumed, but rarely measured in real time.

Verification has traditionally relied on manual inspections, delayed reporting, and fragmented data. These methods are slow, expensive, and prone to error. By the time issues surface, corrective action is limited.

The real challenge isn’t the farmer’s intent.

It’s lending without continuous insight.

What Changes When Farms Become Observable Systems?

The shift begins when farms stop being static assets and start becoming data-rich environments.

Using remote sensing and advanced analytics, farms can now be monitored continuously rather than episodically. Crop type, growth patterns, and stress indicators become visible without physical intervention.

Artificial intelligence and machine learning translate raw imagery into meaningful signals. Yield potential can be estimated using crop models combined with weather and environmental data.

Uncertainty doesn’t disappear.

But it becomes measurable.

And measurable risk is manageable risk.

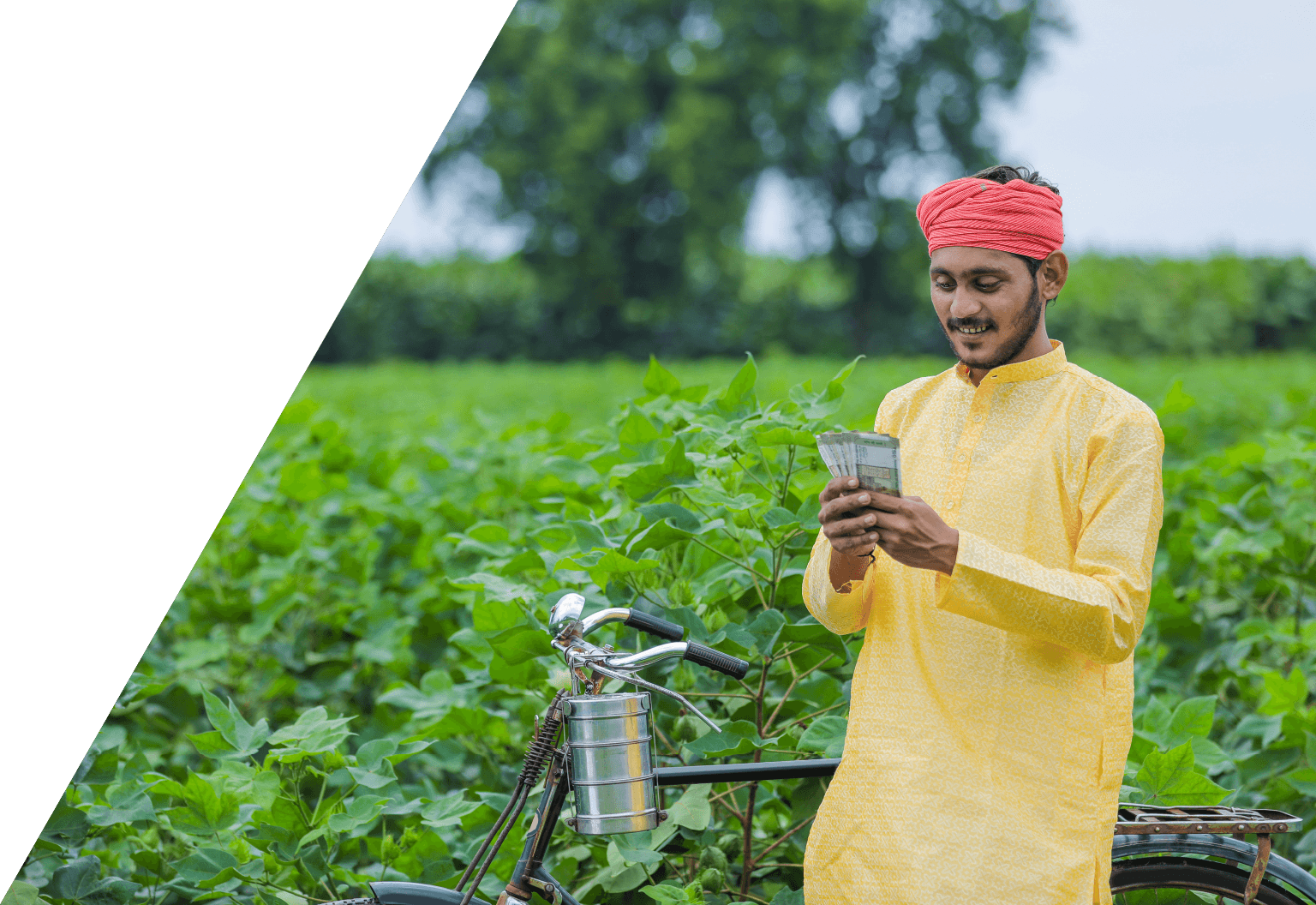

Rethinking Creditworthiness: From Profiles to Performance

One of the most significant changes came from reframing how risk is assessed.

Instead of relying only on borrower history or documentation quality, productivity itself became a core signal. Farm performance was evaluated dynamically, reflecting current conditions rather than past assumptions.

This created a more objective foundation for loan decisions.

Credit stopped being based solely on who the farmer was.

It started reflecting what the farm could realistically deliver.

For financial institutions, this reduced exposure to unforeseen losses.

For farmers, it meant fairer access to capital grounded in actual capability.

When Intelligence Reaches the Field

Insight is only valuable if it drives action.

By delivering timely agronomic and weather intelligence directly to farmers, decisions improved at the source. Inputs could be adjusted. Risks could be anticipated. Stress could be addressed before it affects yield.

Better on-ground decisions translated into healthier crops and more predictable outcomes. And predictability is the quiet backbone of sustainable finance.

In this model, finance doesn’t just observe agriculture.

It actively reinforces it.

What Impact Really Looked Like

The outcome wasn’t simply faster approvals or operational efficiency.

It was continuous visibility into farm conditions.

Early identification of risk instead of explanations that arrive too late.

Stronger alignment between productivity and repayment capacity.

Most importantly, it demonstrated that financial inclusion doesn’t require lowering standards. It requires better information.

From Assumption to Evidence

This shift in agricultural finance isn’t theoretical.

It’s already unfolding where lending decisions are connected to what’s happening on the farm, season by season.

What changes when credit is anchored in live productivity rather than declarations?

How does continuous visibility reshape risk and repayment confidence?

To know more about how this approach works in practice — from farm intelligence to credit decisions and on-ground advisory — you can explore the full story here. Know more

The takeaway is straightforward.

When farms are understood continuously, lending stops being reactive.

It becomes evidence-led — and far more resilient.